ॐ सर्वे भवन्तु सुखिनः

सर्वे सन्तु निरामयाः।

सर्वे भद्राणि पश्यन्तु मा कश्चिद्दुःखभाग्भवेत।

ॐ शान्तिः शान्तिः शान्तिः॥

This is a very famous sloka from the Santhi path of Brihadaranyakopanishad that when translated becomes, ‘May everyone be happy, may everyone be free from diseases, may everyone see the auspiciousness, may no one suffer from misery’. Our government has been continuously working with this mantra. This was most visible during the worst time of the pandemic. Not only do disasters affect people’s lives, but they also bring an economic disaster to their post-disaster recovery phase. Our government was well aware that such a scenario would occur and it is due to this that the government of India has planned and launched Pradhan Mantri Street Vendor’s AtmaNirbhar Bharat scheme or PM SVANidhi Abhiyan. Through this article, we will understand how PM SVANIDHI has changed the lives of lakhs of street vendors in India.

What is PM SVANidhi

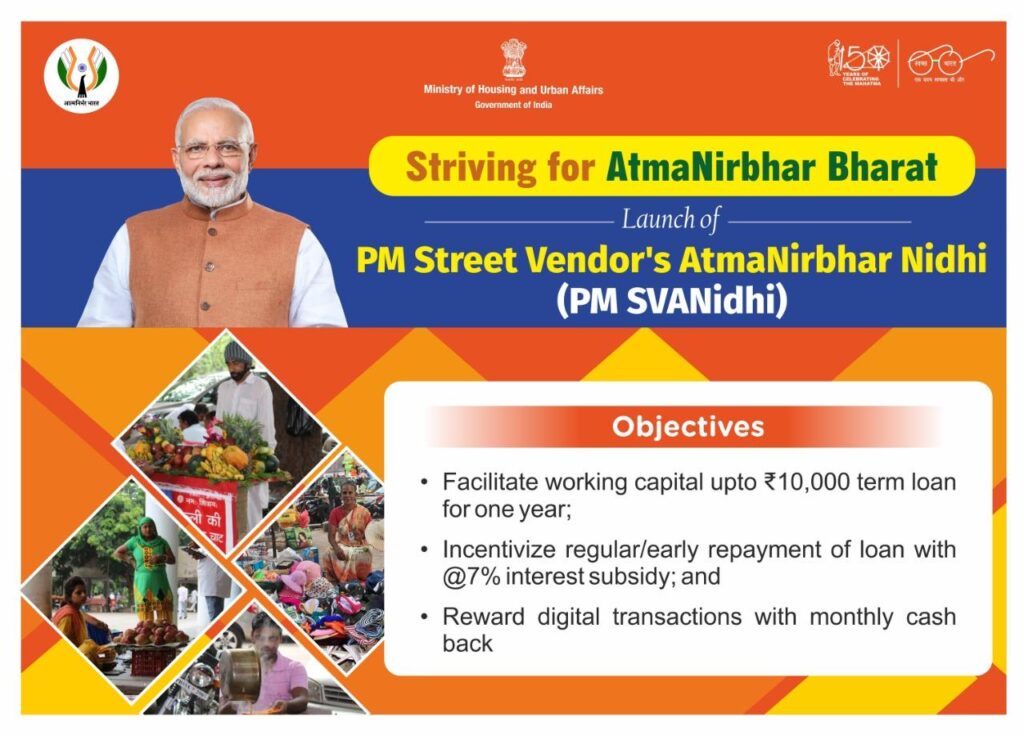

PM SVANidhi scheme is run by the Ministry of Housing and Urban Affairs and is fully funded by the Government of India. The following are some of the objectives of this scheme :

- To facilitate a working capital loan up to Rs.10,000/-with a tenure of 1 year and repaid in monthly installments without any by the lending institutions;

- To incentivize regular repayment; and

- To reward digital transactions

The scheme brings our street vendors to the formalized credit system so that they don’t suffer at the hands of money lenders who charge exorbitant interest rates. On timely repayment of the loans, the street vendors are eligible for the next set of loans with enhanced credit. The scheme is unique since it also helps in the creation of a socio-economic profile of street vendors which makes them easily identifiable for various other schemes and programs of the government. Moreover, the scheme was aimed at digitizing their economic activities, further enhancing digital penetration in our country.

Identification of Street Vendors

The eligible street vendors were identified by the Ministry of Urban Affairs through the local bodies. All those beneficiaries who are in possession of a Certificate of Vending, Identity Cards issued by Urban Local Bodies, and those who are being issued with Letters of Recommendation are found to be eligible under the scheme. As per the provisions of the Street Vendors (Protection of Livelihood and Regulation of street vending ) Act 2014, the issuance of Certificate of Vending and Identity Cards is the responsibility of the Town Vending Committees under the administrative control of respective State Governments. Urban Local Bodies/ Town Vending Committees have been authorized to issue Letter of Recommendations to extend the benefits of PM SVANidhi schemes to street vendors who have been left out of the ULB-led survey or who started vending after completion of the survey. The States/UTs have been advised to complete the fresh survey of street vendors as per the Street Vendor’s ( Protection of Livelihood and Regulations of Street Vending) Act, 2014, and issue CoV to surveyed vendors.

Reasons for the Success of the Scheme

Digitalization of the data makes the scheme more transparent, accessible, and successful. There is equal participation of both the public and private sectors under the scheme. The credit institutions included are not only Scheduled Commercial Banks but Non-Banking Financial Companies (NBFC) as well. The teamwork exhibited by the Banks/NBFCs and ULB officials, coupled with monitoring by the top officials of the State Governments and Central Governments is one of the reasons for the high success of the scheme.

As of 04/08/2023, a total of 106919 loans have been disbursed by Private Sector Banks alone, which indicates good participation of the private sector under the scheme. Regular review meetings have been conducted by Ministry of Finance Officials and the Ministry of Housing, and Urban Affairs Ministry, to regularly improve the private sector’s participation in the scheme. Under the scheme, the rate of interest charged by the lending institution is as per the extent of RBI guidelines. An interest subsidy of 7 percent is paid by the Union Government on a quarterly basis for the timely repayment of EMIs. The street vendors are regularly encouraged to use digital payment systems for which they are provided with assured cashback of up to Rs 1200/- p.a. There is a robust grievance disposal mechanism under the scheme as well. Complaints received under the scheme are forwarded to concerned banks or financial institutions for immediate redress and disposal.

Based on the data available at PM SVANidhi portal, there are 71,91,868 eligible applications under first-term loans. Amongst them 59,49,179 loans are sanctioned and 56,10,865 loans are disbursed by banks and financial institutions that are part of this program. There is an impressive repayment rate where 23,53,800 loans are repaid as of date. An impressive 21,73,228 eligible applicants are there for the second tranche of loan of which 16,77,616 loans have been sanctioned and 15.65,493 have been disbursed by the banks and financial institutions.

A total of 2,46,377 eligible applications were received for the third term loan of which 2,00,573 loans have already been disbursed. On an average, number of days required for the sanctioning of a loan is only 20. There is great emphasis on the socio-economic empowerment of the weaker class and sections under the scheme. Amongst the beneficiaries, nearly 44 percent beneficiaries are women, and OBCs constitute 43 percent of the beneficiaries. The scheme within three years of launch has thus contributed to women’s empowerment, social upliftment, digital empowerment, and credit accessibility to Street Vendors of Bharat and the scheme can thus be justifiably called the SVARNIM Nidhi of Bharat.

(Adarsh Kuniyillam is a Parliamentary and Policy Analyst. Views expressed are his own)

(The views expressed are the author's own and do not necessarily reflect the position of the organisation)