Bad news sells. But in recent years they probably sell at a premium in India. So, when the Indian economy shrunk by nearly 24 per cent in the June quarter, there was a deluge of commentaries, predicting the doomsday for India.

But the reverse happened. If we combine the GST (Goods and Services Tax) collection figures for October returns and the latest PMI numbers, published by HIS Markit; Indian economy is not only recovering, but is doing better than 2019.

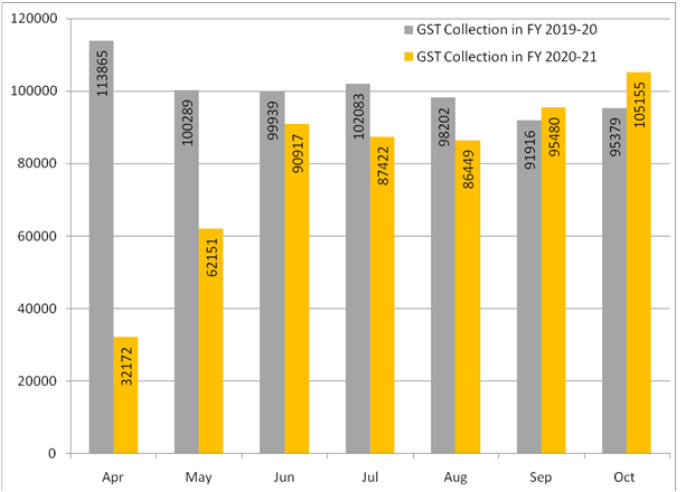

India ended 2019-20 with the decade’s lowest growth number of 4.2 per cent. Growth particularly suffered in the second and third quarter. As in October 2019, GST collection was barely Rs 95,379 crore.

Things are distinctly better this October. The collection was 10 percent higher, compared to last year, at Rs 1,05,155 crore. Revenues from domestic transactions were up by 11 percent. Collection from imports were up by nine per cent.

The detailed datasheet points at many interesting trends. Except Delhi and four more smaller centres, all major centres reported growth. Some of them like Haryana (19 percent), Tamil Nadu (13 per cent), Punjab (15 percent), West Bengal (15 percent) showing sharp growth in collection.

Maharashtra, which alone contributes 15 percent of India’s GST collection, reported five percent growth. Delhi suffered an eight per cent decline. Both the centres were hard hit by pandemic. Noticeably, excepting West Bengal, the rest are producing States. The GST collection therefore reflects rise in both consumption and production.

The production growth actually returned two months as PMI numbers were ruling above 50. As in September, passenger car and two-wheeler sales were booming.

The trend consolidated in October with PMI reaching a decadal high of 58.9. Largest car maker, Maruti, reported 19.2 percent sales growth. Hyundai reported best monthly sales ever. Two-wheeler maker TVS reported 33 percent growth in exports.

The most heartening news is services that contribute 61.5 percent of Indian GDP is finally growing. The PMI for services reached 54.1 in October, up from 49.8 in September.

During the lockdown in April-May, business activity in cities came to a grinding halt thereby wiping out demand for services and impacting GDP. While the commentators were predicting doomsday, cities reopened and the demand returned.

Not rocket science to understand. But then there are times when people prefer to look for complex answer to simple puzzles.

Trends to consolidate

The indications are clear. Consumption suffered due to COVID-19. As the infection rate hit a declining rate, Indian economy rebounded. The growth was gradual in proportion to the reduction in the impact of pandemic and unless there is any fresh nationwide lockdown, the trend will consolidate.

There are reasons behind this optimism. Firstly, the finalized GST numbers based on returns filed in October are actually for consumption in September, which was ahead of the peak festive buying season in October and November.

Though malls were allowed to be reopened in most cities beginning September, due to prolonged lockdown and entrenched fear of COVID-19, the consumer was not forthcoming in going out for a buying spree. Also, due to the overall uncertainty, there was an initial inertia in spending money.

With the economy rebounding and concern over income reducing, such fears and perceptions subsided in the subsequent months and people started going out for shopping or dining.

Consumer behaviour is crucial in economic projections and there is no thumb rule for it. People react differently in different conditions. There was no way to draw any projection on consumer behaviour in India during COVID-19 as the pandemic hit after a century.

Having said that the only common factor behind consumption is what economists often refer to as ‘feel good’.

It is difficult to make a complete assessment of the rising consumption trend at this juncture. This may be partly due to pent up demand and partly for positive outlook. Also, people might have just wanted to beat the fear and just enjoy life, ignoring risks.

The recent uptick in infection graph after weeks of declining trend, does indicate that some people did throw caution to the wind and engaged in revelries during the festive season. And, right now that’s the only concern for the economy.

Meanwhile, the rating agencies, like Moody’s, which were quick to paint a pessimistic picture of Indian economy, started revising their growth estimates upwards.

In September this year, Moody’s revised the annual growth estimates (FY21) drastically downwards from (-) four percent to (-)11.5 per cent. It is now clear that the September growth. Most other rating agencies – like Goldman Sachs, Oxford Economics and SBI Research – followed the trend.

The recent consumption and PMI numbers along with other indicators forced them to revise the projections upwards once again. Moody’s revised forecast to (-)10.6 percent. Oxford is now settling for (-)9.5 percent and SBI Research revised estimates from (-)12.5 percent to (-)10.7 per cent. Barclays is most optimistic expecting a contraction of only (-)6.4 per cent in 2020-2021.

But this may be just the beginning. If the trends continue, the GDP may enter the growth zone once again in October-December quarter and that will change all calculations.

The clue to the future will be available in July-September numbers. Rest assured the economy will report contraction in the September quarter. The question is about the degree of contraction.

(The author is a well-known public policy expert, with interest in economics, connectivity and infrastructure. He writes extensively on these issues. The views expressed are his own.)

(The views expressed are the author's own and do not necessarily reflect the position of the organisation)