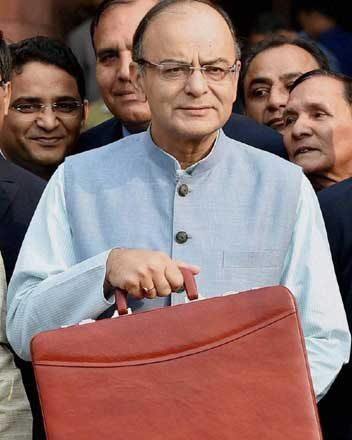

The excitement and the frenzied analysisof the much talked about budget is over. The customary plaudits from the supporters and the brickbats from the opposition in the first few hours is also over. It is time for us to take stock of the budget proposals dispassionately, after taking a deep breath and leaving aside all our emotions.

The founder of Singapore, Mr Lee Kuan Yew had stated in his first speech to the Singapore Parliament in August 1965 that he wanted Singaporeans to remember two things as they started their journey as an independent Nation. His first message to the newly elected Parliamentarians was that the World did not owe Singaporeans a living. His second message was that the planning for their generation, for better or for worse, had already been done and that the parliamentarians needed to think of planning for the next generation of Singaporeans. Keeping these two thoughts at the back of our mind, let us examine the budget presented by our Finance Minister.

The middle class is said to be upset because they feel they have been left out. The wealthy and the entitled are upset because they have not got a reduction in their income taxes. But it is time for this constituency to sit back and acknowledge that they are where they are because previous finance ministers have thought of them. Yes, they can always hope for “more and more” but in a country with such significant income disparities, they need to stop grudging incentives for the very poor and forgotten members of our country. The corporate world needs to go beyond the stipulated Corporate Social Responsibilityif they are to see long term and sustainable growth in India.

The Government, over the past few years has made very courageous moves by implementing structural reforms through the introduction of Demonetisation, Goods and Services Tax and the Bankruptcy Code. The short term problems faced because of these reforms will benefit our economy for many years to come. The fiscal deficit in this budget is being contained at 3.3% showing a strong leaning towards financial prudence in the run up to the elections.

Let us look at the significant budget proposals, both positive and not so positive, that affect the masses in our country.

Health Insurance Scheme – The announcement of the world’s largest health insurance scheme will benefit 10 crore households or 50 crore people. When one realises that this number is 40% of the country, the magnitude of the proposal sinks in. This will truly benefit the common man. Implementation of anything of this magnitude will take time and will have some glitches but as long as the intent and direction are clear, the critics can be conveniently ignored.

Crop Procurement Price – The budget has proposed a 1.5 times increase in the procurement prices of crops which will immediately put more money in the hands of the farmers. This is very significant coming on the back of a consistently increasing procurement price over the past 4 years. This will be augmented with a huge increase in institutional credit for farmers. Though the farmers expected loan waivers, this has not been done. Loan waivers are temporary “fix-its” and offer temporary solutions at a huge cost to the economy.

Operation Green – Taking into account the annual challenges most of the country faces because of the varying prices of potato, tomato and onion, this budget has recommended an Operation Green similar to Operation Flood for milk. Once again, this will help to stabilize the prices of these staple vegetables in all our diets. The impact will be felt over a period of time.

Housing for all by 2022 – The budget continues to lay a strong emphasis on housing for all by 2022, the 75th anniversary of the Republic. Imagine an India where everyone has a roof over their head.

Infrastructure – The Budget continues to commit more funds to building the much needed infrastructure all over the country. The poll bound state of Karnataka received a special mention from the Finance Minister through an enhanced allocation for the Bangalore Metro.

Ujjwala Scheme – This scheme has given free cooking gas to over 5 crore women and the budget proposes to increase this number to 8 crore women. We should sit back and think that for a lot of people, gas is taken for granted and yet such a significant number of our fellow citizens, dependent on wood and coal fires,are getting the benefits of gas for the first time post-independence.

Swachh Bharat – After the installation of 6 crore toilets in the past few years, the budget emphasizes the need to continue this drive and make an additional 2 crore toilets in the coming year. Once again, we should think of something as basic as making India open defecation free has not been available to so many in 7 decades.

Long Term Capital Gains – These have been re-introduced and the cover the Finance Minister has taken is one of a buoyant stock market. Buoyancy of stock markets can never be taken for granted but the long term capital gain is a one way street of paying out cash. This provision needs to be reconsidered and reversed.

Customs Duty Increase – The proposal to increase customs duties is definitely a very retrograde and ill-advised step especially for a country that is pushing for more investments.While this may seem to be a strong step to support “Make in India”, customs duties are always seen as trade barriers and frighten away potential investors. Increasing customs duties on smart phones, the very tool of the masses, while referring to additional investments in Artificial Intelligence and Block chain is baffling to say the least.

If India is to occupy its rightful place in the comity of nations as the 5th largest economy, some sacrifices will have to be made by the people who have “had it all” over the past 7 decades.

(The author is the founder Chairman of Guardian Pharmacies. A keen political observer, he is an Angel Investor and Executive Coach.He is the author of 5 best-selling books, Reboot. Reinvent. Rewire: Managing Retirement in the 21st Century; The Corner Office; An Eye for an Eye; The Buck Stops Here – Learnings of a #Startup Entrepreneur and The Buck Stops Here – My Journey from a Manager to an Entrepreneur.)

(The views expressed are the author's own and do not necessarily reflect the position of the organisation)